Welcome to the website of Hebi Yuxing Coal Machinery Co., Ltd.!

Hotline:

The coal industry's economic performance is primarily characterized by the following features:

2022-07-07

At the third online forum in the series analyzing China's industrial economic trends, themed "Manufacturing Sector Tackling the Severe Impact of the Pandemic," Zhang Hong, Secretary of the Discipline Inspection Commission of the China National Coal Association, highlighted that the nation's coal industry is currently experiencing continued capacity release, subdued demand, and declining prices. As a result, the market for mine hoists is clearly oversupplied, placing significant operational challenges on coal enterprises in older mining regions.

Zhang Hong stated that, from the perspective of coal demand, economic and social activities are gradually returning to normal amid ongoing routine COVID-19 prevention and control measures. Production and daily life are picking up pace, while new industries and business models continue to grow rapidly. As various policy measures take effect, the overall economic and social rhythm is accelerating its recovery, and energy demand—especially coal—is expected to rebound positively. By the second quarter of this year, demand in key coal-consuming sectors such as power generation, steel, building materials, and chemicals is projected to steadily return to normal levels.

He explained that the coal industry's economic performance is characterized by the following key features:

First, demand has declined. Preliminary estimates show that national coal consumption in the first quarter was approximately 870 million tons, a year-on-year decrease of 6.8%. Specifically: the power sector consumed 507 million tons of coal, down 6.8% from the previous year; the steel industry used 146 million tons, up 1.5%; the building materials sector consumed 65 million tons, a significant drop of 24.7%; the chemical industry used 61 million tons, slightly lower by 0.9%; and coal usage continued to decline across other industries.

Second, supply has increased. In the first quarter, coal production by large-scale enterprises across the country reached 830 million tons of raw coal, a decrease of approximately 4 million tons compared to the same period last year.

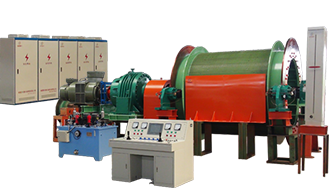

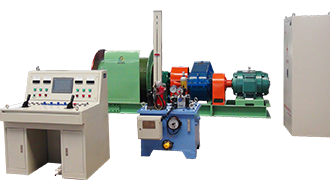

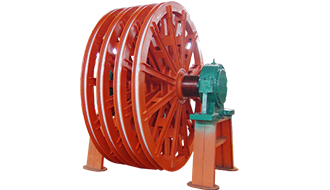

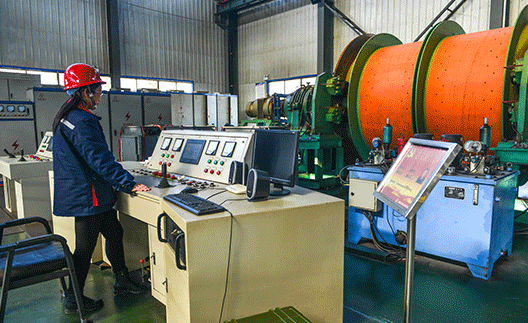

China's leading manufacturer of JKMD multi-rope friction mine hoists

Down by 0.5%; in March, raw coal production shifted from negative growth to positive, reaching 337.26 million tons—a 9.6% year-on-year increase. Among them, Shanxi Province saw its raw coal output rise by 12.3% compared to the same period last year, driven by the multi-rope JKM series friction-type ground-mounted mine hoist models. Meanwhile, Yulin City in Shaanxi Province experienced a remarkable 30.9% surge in raw coal production capacity year-on-year. In the first quarter, China’s total coal imports amounted to 95.778 million tons, up 21.178 million tons—or 28.4%—from the previous year.

Third, inventory levels have increased. As of the end of March, coal inventories at coal enterprises stood at 55 million tons, up by 1.2 million tons—or 2.2%—from the beginning of the year. Meanwhile, major ports across the country collectively held 58.73 million tons of coal, representing a month-on-month rise of 10.4%. Among these, northern ports accumulated 25.12 million tons, marking a significant 27% increase compared to the previous month, while ports in the Yangtze River Delta region held 14.98 million tons, up slightly by 1.8% from the prior month. Nationally, centrally managed power plants maintained coal stocks totaling 119.08 million tons, enough to cover 25 days of operations.

Fourth, prices have declined. Medium- to long-term contract prices have remained stable within the "green zone"; from January to April 2020, the average price was 543.5 yuan per ton, slightly lower than the full-year average of 555.3 yuan per ton in 2019 for the multi-rope JKMD series friction-type ground-mounted mine hoist models. Meanwhile, spot market prices for thermal coal have dropped significantly—on April 15, the quoted price for 5,500 kcal thermal coal at the Bohai Rim region had fallen by 78 yuan per ton compared to February levels. Coking coal prices also experienced a sharp decline: as of March 31, the comprehensive price of high-quality coking coal (Jiaofei) from Shanxi stood at 1,328 yuan per ton, down 140 yuan per ton from the previous month and a substantial 281 yuan per ton lower year-on-year.

Fifth, profitability has declined. In the first quarter of this year, coal enterprises of designated size across the country reported total profits of 42.1 billion yuan, yet the output from high-quality manufacturers of explosion-proof, isolating-type, high-voltage variable-frequency hoists—key equipment for mining—fell by 29.9% year-on-year. Notably, large enterprises, which account for approximately 80% of the nation’s total coal production, contributed around 50% of the industry’s overall profit. Meanwhile, the top 20 companies generated roughly 70% of the sector’s total profits. However, some enterprises have yet to turn a profit and remain in financial distress, highlighting significant imbalances and inequalities in industry development. Older mining regions and established companies are facing mounting operational pressures, while others continue to grapple with challenges such as tight cash flow, heavy debt repayment burdens, and persistent wage arrears.

He believes that, throughout the year, the national coal market will generally maintain a balanced supply-and-demand situation, with a slightly relaxed tone. However, factors such as water inflows in southern regions, the 2020 pricing trends for coal mine and metal mine hoisting winches used in underground operations, hydropower generation levels, and regional or seasonal climate patterns could introduce some uncertainties into the market. Therefore, it’s crucial to prioritize energy security and stable supply by proactively preparing and ensuring adequate coal availability well in advance.

Follow us

Hebi Yuxing Coal Machinery Co., Ltd.

Hotline:+86-13939219076

Technical Consultation:+86-13503925535

Address: Yuxing Industrial Park, Shancheng, Hebi City, Henan Province

You are a helpful assistant.

Copyright © Hebi Yuxing Coal Machinery Co., Ltd. SEO tags Business license

Copyright © Hebi Yuxing Coal Machinery Co., Ltd.Business license

This website supports IPv6 and SEO tags.