Welcome to the website of Hebi Yuxing Coal Machinery Co., Ltd.!

Hotline:

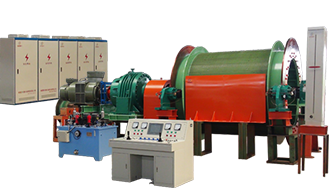

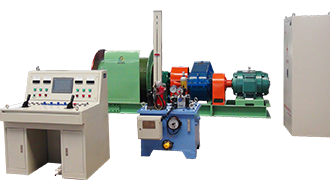

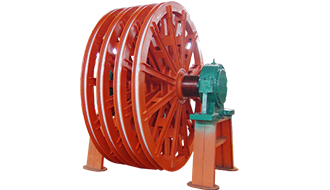

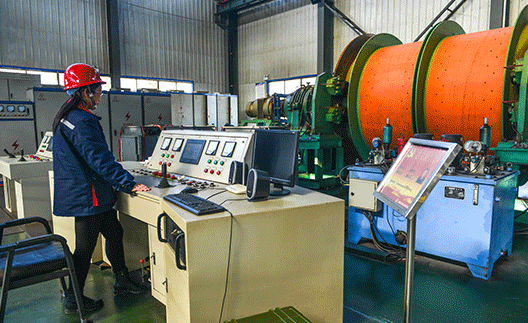

Multi-rope Friction Mine Hoist | JK New-Type Mine Hoist Winch Configuration Parameters

2022-07-07

Analysis and Forecasting

Spot market prices remained largely stable, with most transactions occurring at lower price levels—high-price deals proved particularly challenging. This "double bind" situation indicates that while there is some trading activity in the market, it’s not strong enough to drive prices higher.

According to the recently released national market data, rebar production this week increased for the seventh consecutive week, reaching 3.4344 million tons—nearly matching last year's level of 3.5538 million tons. Meanwhile, the weekly inventory reduction for five major steel products totaled 1.9263 million tons, up from 1.8257 million tons the previous week, aligning closely with expectations of continued growth in market transactions. Looking ahead, domestic production is expected to rise further next week, while inventory levels are likely to maintain their downward trend.

Affected by the pandemic, U.S. economic data have been weak, deepening investors' concerns about the potential severity of the crisis on the U.S. economy. As a result, U.S. stocks plunged sharply on Wednesday. Meanwhile, the IEA monthly report projected that oil demand in April would drop by 29 million barrels per day compared to the same period last year—falling to levels not seen since 1995. Crude oil prices also dipped below $20 a barrel, hitting yet another intraday low. Looking ahead, global financial and commodity markets are expected to enter a period of consolidation and adjustment, following an earlier rebound, as real-world economic indicators—mirroring domestic economic trends—are now being weighed against the ongoing impact of the pandemic. At the same time, market participants are closely monitoring the global spread of the virus, as well as developments related to Europe and the U.S. reopening plans.

On the steel market front, China’s supportive policies remain in place. Liu He chaired the 26th meeting of the State Council’s Financial Stability and Development Committee, emphasizing the need to address both overall demand and structural adjustments, while simultaneously boosting supply and demand. He also stressed the importance of effectively implementing all policy measures aimed at supporting the real economy, particularly small, medium, and micro-sized enterprises. On the 15th, the People’s Bank of China announced a targeted reserve requirement ratio cut of 0.5 percentage points for smaller banks, injecting approximately 200 billion yuan in long-term liquidity. Market expectations suggest that more policies aimed at boosting domestic demand are likely on the horizon.

Currently, the volume of transactions in the spot market is insufficient to provide strong support for market prices, while short-process electric furnace production continues to ramp up, putting additional pressure on sales. We expect that terminal demand may still have some room to recover, but for now, the month-on-month increase in market activity remains relatively limited.

After discussions with traders and others, we’ve observed that some end-users are currently facing funding shortages. Although production has resumed, this liquidity issue is still impacting market purchasing activities. For now, the spot market is being viewed as a technical correction, so we’ll closely monitor how trading activity holds up under these conditions.

Additionally, this morning market rumors surfaced that, due to Tangshan's significantly worsened air pollution ranking, the city’s mayor has ordered a further tightening of emission controls—set to remain in place until the end of the month—and instructed the implementation of tailored measures for each individual steel plant, down to the specifics of their equipment. In recent days, local steelmakers in Tangshan have been continuously summoned for discussions, with officials signaling that formal written directives may no longer be issued; instead, production restrictions will now be enforced strictly according to the outcomes of these government-led meetings. Given that the heating season control period is nearing its end, however, these tightened measures in Tangshan are unlikely to have a major impact on the current market dynamics.

Follow us

Hebi Yuxing Coal Machinery Co., Ltd.

Hotline:+86-13939219076

Technical Consultation:+86-13503925535

Address: Yuxing Industrial Park, Shancheng, Hebi City, Henan Province

You are a helpful assistant.

Copyright © Hebi Yuxing Coal Machinery Co., Ltd. SEO tags Business license

Copyright © Hebi Yuxing Coal Machinery Co., Ltd.Business license

This website supports IPv6 and SEO tags.